Category: FinTech

Price Prediction for Bitcoin

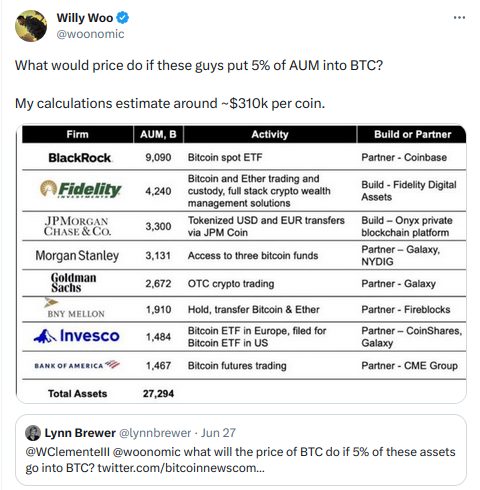

What happens to the price of bitcoin if the big investment firms decide to allocate 5% to AUM (Assets Under Management)? “Around ~$310k per coin.”

Inflation & Fiat Currencies

- History of Currencies (The Bitcoin Standard) on how all currencies go to worthless over time

- Governments were based on Gold Reserves

- Governments migrated to Fiat from Gold in the twentieth century (because of centralization and corruption)

- Governments are printing currency to pay bills = Inflation

- ShadowStats example

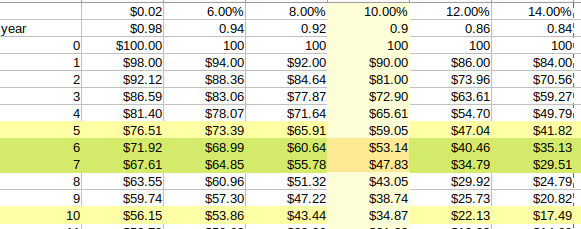

- Spreadsheet with 10% inflation example (between 6-7 years to debase money by 50%)

- Lynn Alden suggests a decade of inflation as debts are too much to be paid except by printing more currency, thereby debasing currency. The interest on the US debt is just too much to pay!

- Therefore, move money out of currency into other assets

History has shown that governments will inevitably succumb to the temptation of inflating the money supply…. government will always find a reason or way to print more money, expanding government power while reducing the wealth of the currency holders.

Saifedean Ammous, from The Bitcoin Standard, page 67

On ShadowStats.com, near the bottom of a ridiculously long home page, there’s a couple useful paragraphs:

Have you ever wondered why the CPI, GDP and employment numbers run counter to your personal and business experiences? The problem lies in biased and often-manipulated government reporting. Primers on Government Economic Reports What you’ve suspected but were afraid to ask. The story behind unemployment, the Federal Deficit, CPI, GDP.

ShadowStats.com

The above chart shows how long it takes to lose 50% of one’s money at 10% inflation per year–between 6 & 7 years.

Lynn Alden, who I consider to be a respectable economy wonk, says:

My base case going forward continues to be that with the combination of sizable broad money supply growth, along with public opinion pushing the pendulum back away from globalization, consumer price inflation is likely to be higher in the 2020s decade than in the 2010s decade.

Last, summary paragraph of a really really long information rich page

Given diminishing returns or cycle what level of return might we look forward to in the next cycle once BTC bottoms?

Video recording date: December 19, 2022

The Ethereum Killers Are All Zombies Now

The Merge made it starkly visible to the world, but blockchain insiders have known for years that Ethereum’s assassins have fired their shots and missed.

If the best technology doesn’t seem to win, what separates long-term winners out in these standards battles? I hypothesize that there are two answers. First, developer ecosystem maturity and, second, management team.

[Ethereum has both ecosystem & management maturity.]

What does this mean for Ethereum’s well-funded would-be assassins such as Solana, Terra, Avalanche and others? I think it means they are zombies, technically still alive but running on borrowed time. How much time? It could be quite a few years. Competitors to the PC kept on going for more than a decade after Windows became the dominant platform. It won’t surprise me if some Ethereum killers are still trucking along with ever-diminished market share and crowds of online influencers shilling them in 2030.