- History of Currencies (The Bitcoin Standard) on how all currencies go to worthless over time

- Governments were based on Gold Reserves

- Governments migrated to Fiat from Gold in the twentieth century (because of centralization and corruption)

- Governments are printing currency to pay bills = Inflation

- ShadowStats example

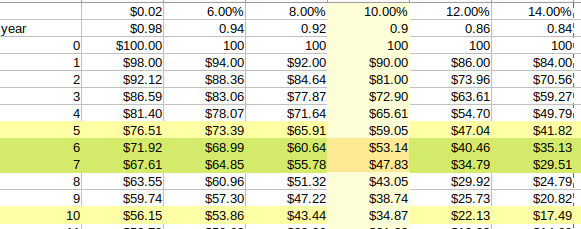

- Spreadsheet with 10% inflation example (between 6-7 years to debase money by 50%)

- Lynn Alden suggests a decade of inflation as debts are too much to be paid except by printing more currency, thereby debasing currency. The interest on the US debt is just too much to pay!

- Therefore, move money out of currency into other assets

History has shown that governments will inevitably succumb to the temptation of inflating the money supply…. government will always find a reason or way to print more money, expanding government power while reducing the wealth of the currency holders.

Saifedean Ammous, from The Bitcoin Standard, page 67

On ShadowStats.com, near the bottom of a ridiculously long home page, there’s a couple useful paragraphs:

Have you ever wondered why the CPI, GDP and employment numbers run counter to your personal and business experiences? The problem lies in biased and often-manipulated government reporting. Primers on Government Economic Reports What you’ve suspected but were afraid to ask. The story behind unemployment, the Federal Deficit, CPI, GDP.

ShadowStats.com

The above chart shows how long it takes to lose 50% of one’s money at 10% inflation per year–between 6 & 7 years.

Lynn Alden, who I consider to be a respectable economy wonk, says:

My base case going forward continues to be that with the combination of sizable broad money supply growth, along with public opinion pushing the pendulum back away from globalization, consumer price inflation is likely to be higher in the 2020s decade than in the 2010s decade.

Last, summary paragraph of a really really long information rich page