This is a short excerpt from Venture Capitalist Chamath Palihapitiya on CNBC, Dec 12, 2017.

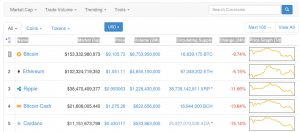

I wrote an article about bitcoin in 2013. There is so much asymmetric upside here. This is a thing that goes to roughly the value of gold. There’s very little downside.

Take 1% of your money and put it into schmuck insurance. This is now a confidence game, this is a hedge against autocratic regimes and banking structures that are corrosive to how the world needs to work properly. You cannot have central banks infinitely printing currency, you cannot have guys with misdirected and misguided fiscal policy…

So we’ve seen the first few chapters of this and now we have to see the great unwind. [Referring to QT: quantitative tightening]

All I’m saying is its a hedge against the infrastructure that made those decisions without our input is a smart thing.

I think 1 bitcoin will be worth $100,000 in 3 to 4 years, and in the next 20 years, a million dollars a coin.

Former Facebook Exec Chamath Palihapitiya On Social Media, Bitcoin, And Elon Musk (Full) | on CNBC.

Here’s the link: 10:20 in, Let’s Talk Bitcoin:

https://www.youtube.com/watch?v=5zyRpq2ODrE&t=620s

I like to listen to economic news at night and recently heard this lady, Nomi Prins, who was a Goldman Sachs manager, then journalist, talk about the history of the Federal Reserve in America. Her book,

I like to listen to economic news at night and recently heard this lady, Nomi Prins, who was a Goldman Sachs manager, then journalist, talk about the history of the Federal Reserve in America. Her book,